Adjustments are made for holiday and vacation days. Neuvoo online salary and tax calculator provides your income after tax if you work in california.

2021 Technology Salary Guide Robert Half

2021 Technology Salary Guide Robert Half

Experiment with other financial calculators or explore hundreds of individual calculators covering other topics such as math fitness health and many more.

Salary calculator california 2020. Payroll check calculator is updated for payroll year 2020 and new w4. Use gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in california. However the irs has made revisions to the form w 4 for 2020.

If you live in one location but work in another the cost of living calculator will make those adjustments to provide an accurate estimate of the change in col. The new version removes the use of allowances along with the option of claiming personal or dependency exemptions. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts.

2021 california state tax tables. 2020 california state tax tables. Divide each employee s annual salary by the number of pay periods your business has.

The california state tax tables are provided here for your reference. We calculate how much your payroll will be after tax deductions in any region. Instead it requires that the filer enter specific dollar amounts and it uses a five step process that lets you enter personal information claim dependents and.

Find your net pay for any salary. California salary tax calculator for the tax year 2020 21 you are able to use our california state tax calculator in to calculate your total tax costs in the tax year 2020 21. Our calculator has recently been updated in order to include both the latest federal tax rates along with the latest state tax rates.

California salary paycheck calculator change state calculate your california net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local w4 information into this free california paycheck calculator. The california state tax tables listed below contain relevent tax rates and thresholds that apply to california salary calculations and are used in the california salary calculators published on icalculator. We ll do the math for you all you need to do is enter the applicable information on salary federal and state w 4s deductions and benefits.

Our data is based on 2020 tax tables from usa. You can use our california payroll calculator to figure out your employees federal withholding as well as any additional taxes you are responsible for paying as the employer. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employee s w4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

For 2020 the rate is at 1 0 of annual income up to 122 909 which.

Introducing Salary Explorer A New Way To Compare Nursing Salaries Introducing Trusted S Nurse Salary Explorer The Most Compre In 2020 Nurse Salary Nurse Nursing Jobs

Introducing Salary Explorer A New Way To Compare Nursing Salaries Introducing Trusted S Nurse Salary Explorer The Most Compre In 2020 Nurse Salary Nurse Nursing Jobs

Calculating Benefit Payment Amounts

Calculating Benefit Payment Amounts

Texas Paycheck Calculator Smartasset

Texas Paycheck Calculator Smartasset

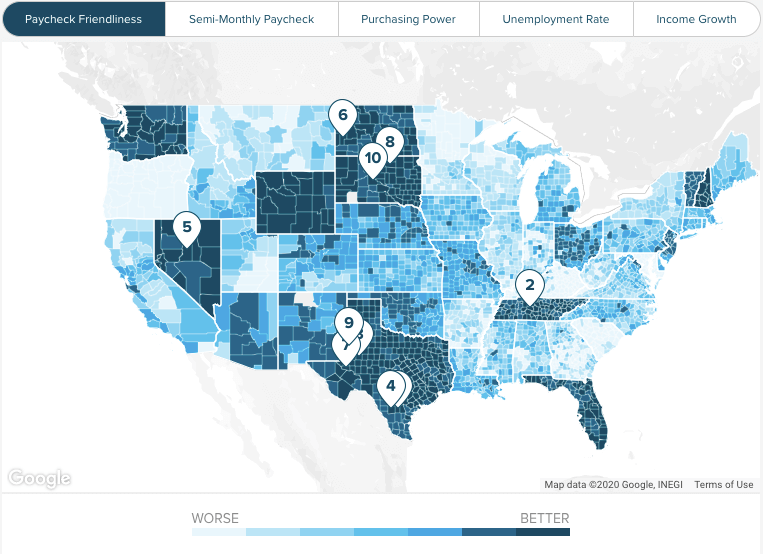

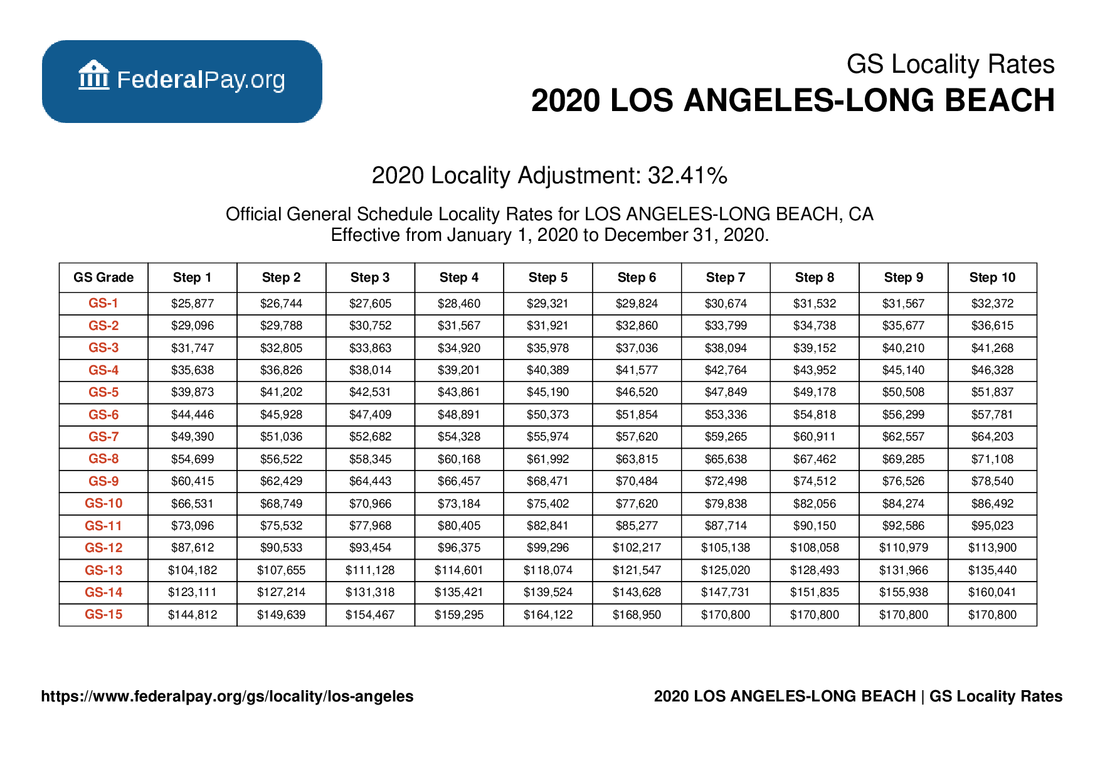

Los Angeles Pay Locality General Schedule Pay Areas

Los Angeles Pay Locality General Schedule Pay Areas

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Salary And Benefits Green Dot Public Schools Careers

Payroll Calculators Tools California Payroll Services

Payroll Calculators Tools California Payroll Services

0 comments:

Post a Comment