What does gross salary mean. Net earnings are the pay you bring home after all deductions are subtracted from the gross pay.

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

All other calculations regarding compensation and taxes begin with gross pay.

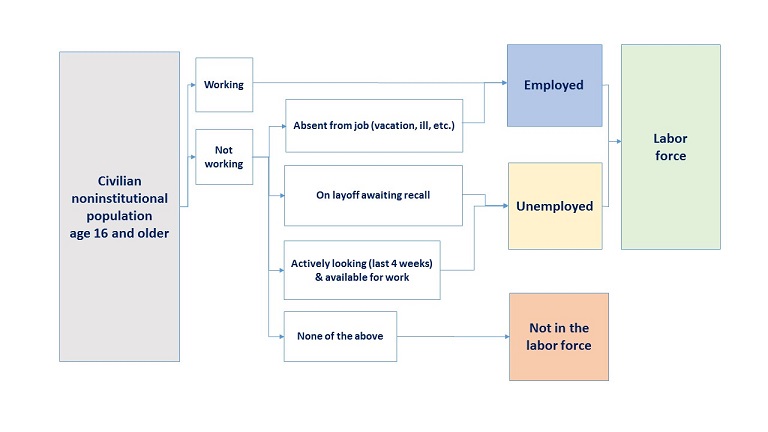

Gross salary definition unemployment. The level of unemployment benefits a worker is eligible to receive depends largely on that employee s gross wages during the eligibility period. It is the gross monthly or annual sum earned by the employee. For a worker a gross wage is simply everything earned during the period before the removal of taxes or any special payments.

For hourly employees hours worked may include waiting time on call time breaks travel time overtime and training. Gross pay is the amount of an employee s wages or salary before any taxes or deductions are taken out. Gross salary is determined by the employer when the job is offered.

When you file for unemployment benefits you must report your gross earnings which is the total wages earned before deductions such as federal state and local taxes insurance pensions 401 k and miscellaneous deductions such as union dues. Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted. Gross salary is the term used to describe all of the money you ve made while working at your job figured before any deductions are taken for state and federal taxes social security and health.

Letter Of Unemployment Verification Fresh Unemployment Verification Letter Filename Template In 2020 Job Cover Letter Examples Letter Template Word Job Cover Letter

Letter Of Unemployment Verification Fresh Unemployment Verification Letter Filename Template In 2020 Job Cover Letter Examples Letter Template Word Job Cover Letter

Total And Partial Unemployment Tpu 460 55 Pension Or Retirement Pay

Total And Partial Unemployment Tpu 460 55 Pension Or Retirement Pay

Florida Unemployment Do You Know Your Rights Aboutunemployment Org

Florida Unemployment Do You Know Your Rights Aboutunemployment Org

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

0 comments:

Post a Comment