It is usually paid by cheque or through netbanking. Let s assume our company also has salaried employees who are paid semimonthly on the 15th and the last day of each month.

The Highest Fresh Graduate Salaries In Malaysia 2019 Eduadvisor

The Highest Fresh Graduate Salaries In Malaysia 2019 Eduadvisor

In this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages payroll withholdings and employer costs related to payroll.

Salary journal entry malaysia. Salary is an indirect expense incurred by every organization as consideration for the efforts undertaken by the employees of the organization. Salary payable is an accrued liability and therefore credited in the books of accounts. Journal entry for salary paid.

In this case in the december 31 adjusting entry the company abc needs to make journal entry for accrued salaries to recognize the salary expense that has already occurred as below. On one hand salary is debited being the expense for the company and on other hand a liability is created with the name of salary payable. Salary is an indirect expense incurred by every organization with employees.

Here i will explain you the journal entry for salary paid by cheque. Examples of payroll journal entries for salaries. Examples of payroll journal entries for wages.

Salary expense is recorded in the books of accounts with a journal entry for salary paid. When abc company issues mary her payroll check for the most recent accounting period they would post the following entry to decrease debit the wage payable account balance and payroll tax balance and decrease credit cash in accounting software such as quickbooks you will credit the bank account you are paying your employee from 2 payroll journal entry for salary payable. It is one of the most recurring transactions because it is paid monthly.

Salary is paid by every organization to its employees and that is the reason why it is important to know what journal entries are passed for recording salary into books of account. The journal entry for salary payable is shown below. It is paid as a consideration for the efforts undertaken by the employees for the business.

In the first method following entry is passed. In the following examples we assume that the employee s tax rate for social security is 6 2 and that the employer s tax rate is 6 2. The amount of salary in december 2019 is 15 000 and the payment will be made on january 03 2020.

It is applicable for all employees whose salary is rs 15000 per month. The employee portion will be deducted from salary and paid to esi corporation including employer contribution. The employer contributes 4 75 percent and employee contributes 1 75 percent total of 6 5 percent.

Journal entry for salary can be passed in 2 ways. In the following examples we assume that the employee s tax rate for social security is 6 2 and that the employer s tax rate is 6 2. Salary payable journal entry.

Resume Templates Jobstreet Resume Templates Resume Templates Resume Examples Resume

Resume Templates Jobstreet Resume Templates Resume Templates Resume Examples Resume

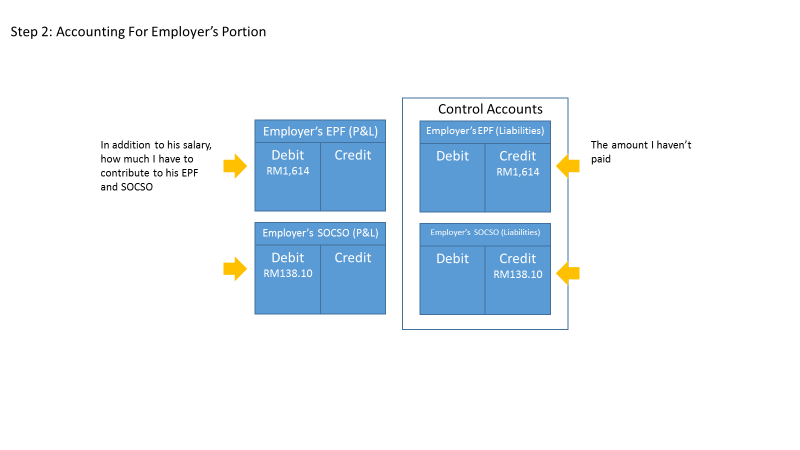

Salary How To Enter Salary And Epf In Treezsoft Treezsoft Blog

Salary How To Enter Salary And Epf In Treezsoft Treezsoft Blog

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

Payroll Accounting Process Double Entry Bookkeeping

Payroll Accounting Process Double Entry Bookkeeping

3 Steps To Get Payroll Data Into Your Accounting System

3 Steps To Get Payroll Data Into Your Accounting System

6 Salary Slip Format In Excel Malaysia Salary Slip School Pay Salary Slip

6 Salary Slip Format In Excel Malaysia Salary Slip School Pay Salary Slip

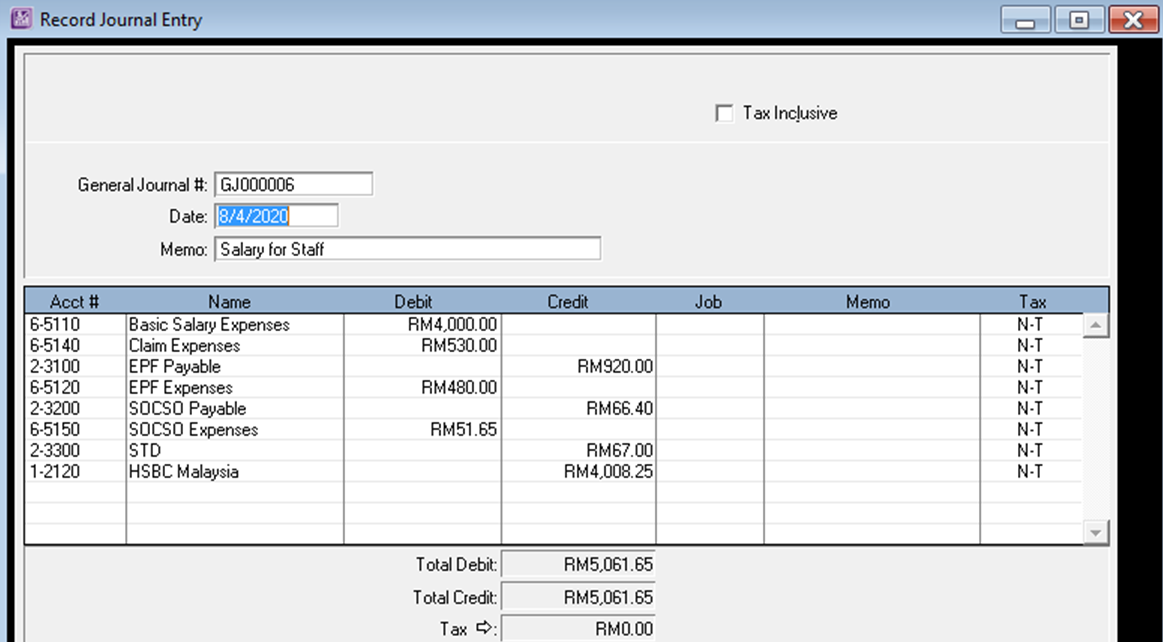

How To Record Employee Salary In Premier Accounting My Abss Support

How To Record Employee Salary In Premier Accounting My Abss Support

0 comments:

Post a Comment