The difference between salaries payable and salaries expense is that the expense encompasses the full amount of salary based compensation paid during a reporting period while salaries payable only encompasses any salaries not yet paid as of the end of a reporting period. The account wages and salaries expense or separate accounts such as wages expense or salaries expense are used to record the amounts earned by employees during the accounting period under the accrual basis of accounting.

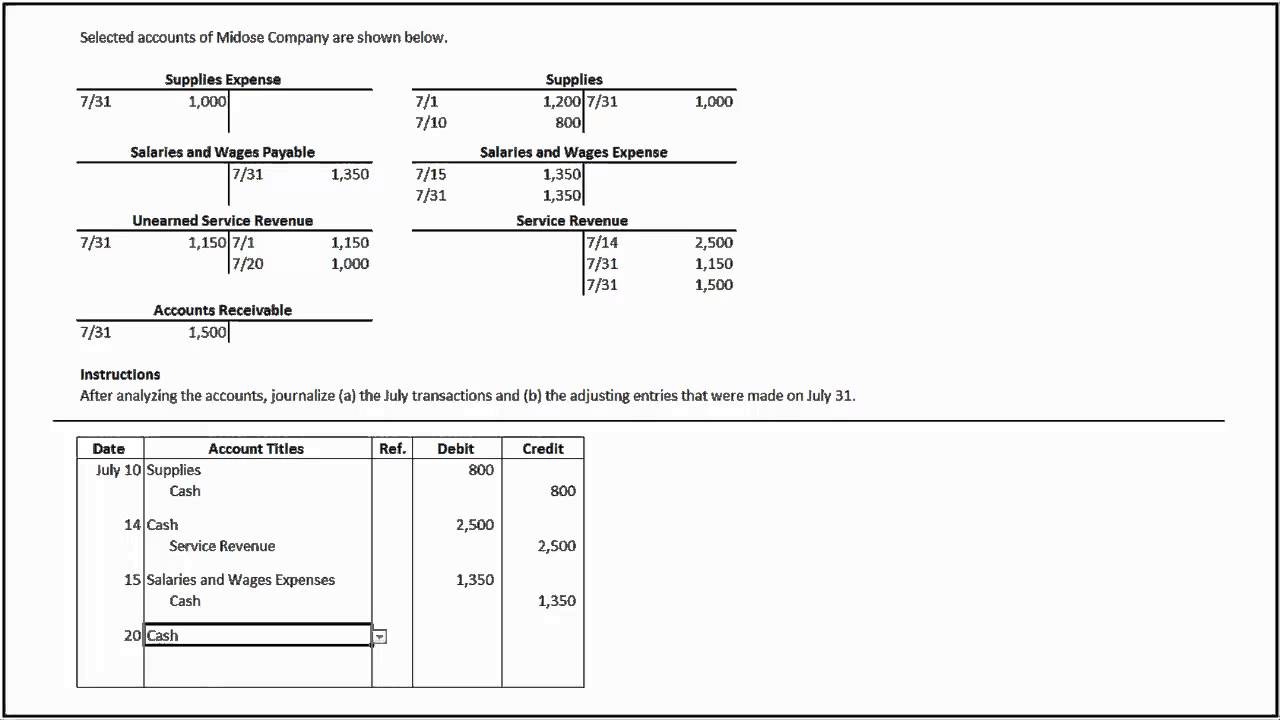

How To Journalize Basic Transactions And Adjusting Entries Accounting Principles Youtube

How To Journalize Basic Transactions And Adjusting Entries Accounting Principles Youtube

It is frequently subdivided into a salaries expense account for individual departments such as.

Salary expense t account. Examples of expense accounts include salaries expense wages expense rent expense supplies expense and interest expense. Suppliers accruals operating expenses for goods or services rendered by a third party supplier. Purchased used automobile for 19 500 paying 2 500 cash and giving a note payable for the remainder.

Transferred cash from a personal bank account to an account to be used for the business 18 000. Thus the amount of salaries payable is usually much lower than the amount of salaries expense. How to debit and credit salaries expenses.

Definition of wages and salaries expense. In this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages payroll withholdings and employer costs related to payroll. Interest expense accruals interest expenses that are owed but unpaid.

Salaries expense accounting department. It pays the salaries in cash. In accounting the salaries and wages expense arise when the employees do their jobs.

In practice salaries and wages expense is recorded when cash is paid by debiting salaries and wages expense and crediting cash. Salaries expense is the fixed pay earned by employees. Wage or salary accruals these include salaries owed to employees who work for part of the month without having received their full earned monthly salary.

On january 26 fac owes its employee salaries of 4 000. The expense represents the cost of non hourly labor for a business. Salaries expense will usually be an operating expense as opposed to a nonoperating expense.

Salaries expense engineering department. In the following examples we assume that the employee s tax rate for social security is 6 2 and that the employer s tax rate is 6 2. Under the accrual method of accounting the account salaries expense reports the salaries that employees have earned during the period indicated in the heading of the income statement whether or not the company has yet paid the employees.

In a t account their balances will be on the left side. To illustrate an expense let s assume that on june 1 your company paid 800 to the landlord for the june rent. Accounts receivable 18 120 prepaid insurance 980 expenses automobile 20 650 salary expense 14 380 furniture and equipment 5 963 rent expense 10 320 liabilities automobile expense 859 accounts payable 1 590 utilities expense 1 213 owner s equity supplies expense 840.

Examples of payroll journal entries for wages.

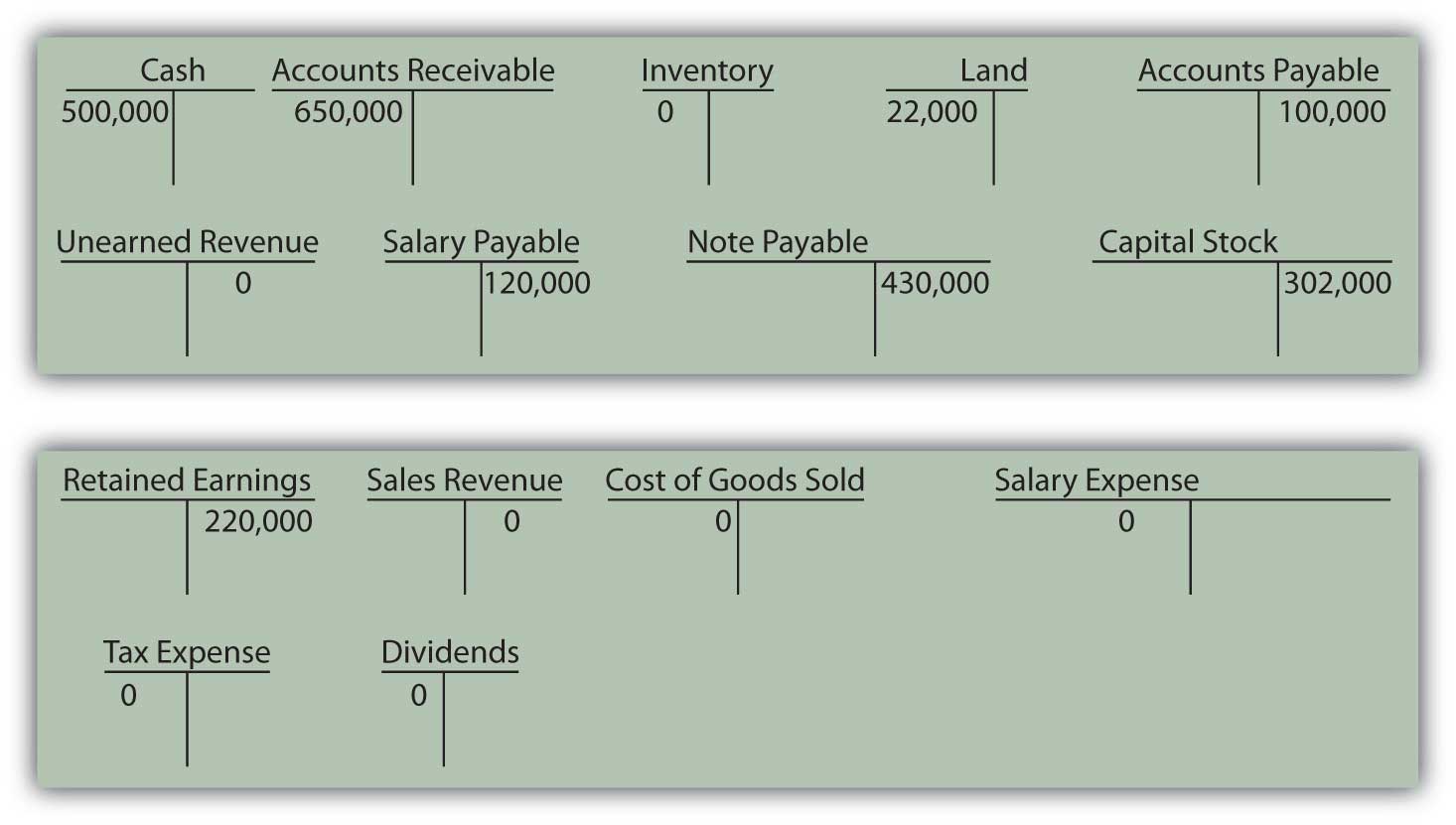

4 6 End Of Chapter Exercises Financial Accounting

4 6 End Of Chapter Exercises Financial Accounting

How To Prepare Trial Balance Wikiaccounting

How To Prepare Trial Balance Wikiaccounting

Lo4 Recording Payroll Tax Deposits And End Of Period Adjustments Acct 032 Payroll Accounting

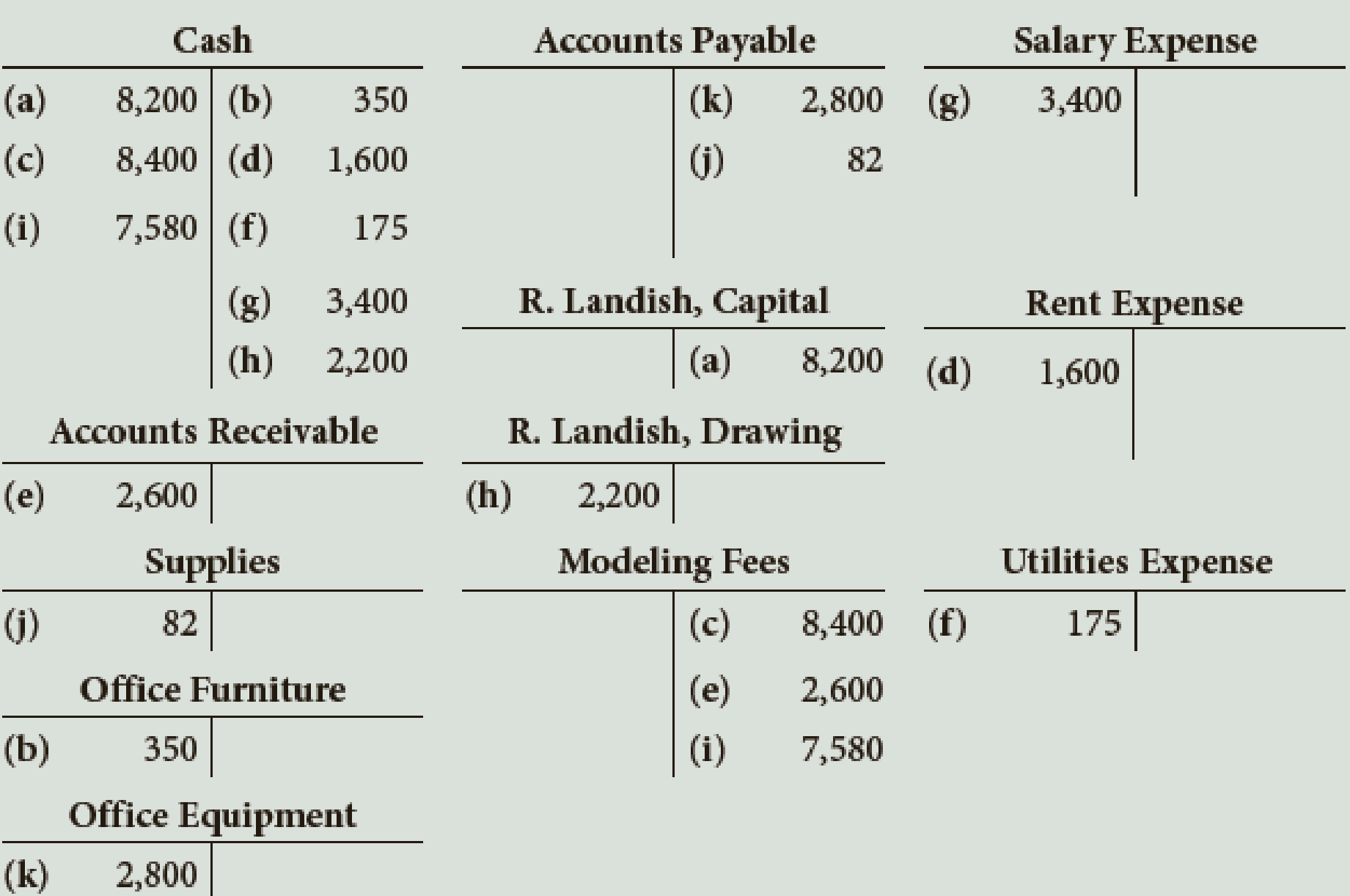

During The First Month Of Operations Landish Modeling Agency Recorded Transactions In T Account Form Foot And Balance The Accounts Then Prepare A Trial Balance An Income Statement A Statement Of Owner S

During The First Month Of Operations Landish Modeling Agency Recorded Transactions In T Account Form Foot And Balance The Accounts Then Prepare A Trial Balance An Income Statement A Statement Of Owner S

Debits And Credits Explanation Accountingcoach

Debits And Credits Explanation Accountingcoach

T Account Examples Step By Step Guide To T Accounts With Examples

T Account Examples Step By Step Guide To T Accounts With Examples

0 comments:

Post a Comment