Hourly rates weekly pay and bonuses are also catered for. Let s say in the example below that your yearly wage is 50 000.

Net Salary Greece Salary Calculator National Insurance Insurance Classes

Net Salary Greece Salary Calculator National Insurance Insurance Classes

Employers use this system to take income tax and national insurance contributions from.

Salary calculator uk after tax. Free tax code calculator transfer unused allowance to your spouse. Share this income tax calculator uk united kingdom salary overview. The salary calculator tells you monthly take home or annual earnings considering uk tax national insurance and student loan.

The latest budget information from april 2020 is used to show you exactly what you need to know. Tax free childcare take home over 500 mth. The salary calculator tells you monthly take home or annual earnings considering uk tax national insurance and student loan.

This places united kingdom on the 5th place out of 72 countries in the international labour organisation statistics for 2012. Calculate how much money you ll be left with after tax based on your yearly monthly weekly daily and hourly earnings. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself.

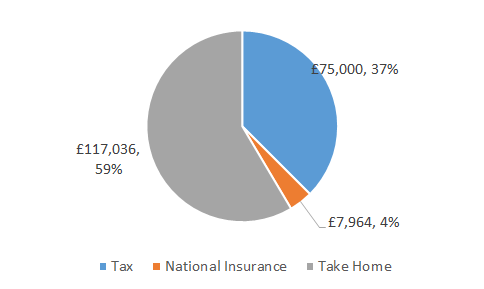

Check your tax code you may be owed 1 000s. In this case after tax and national insurance. You will take home 3 137 every month.

Use salarybot s salary calculator to work out tax deductions and allowances on your wage. Gross to net salary calculator 2020 2021 the 2020 2021 net salary calculator below outlines the net salary amount for each possible gross salary level within the uk. 20 000 after tax breaks down into 1 415 monthly 330 00 weekly 66 00 daily 9 63 hourly net salary if you re working hours per week.

The average monthly net salary in the uk is around 1 730 gbp with a minimum income of 1 012 gbp per month. Marriage tax allowance reduce tax if you wear wore a uniform. Why not find your dream salary too.

20 000 after tax is 16 981 annually based on 2020 tax year calculation. The net salary amounts are calculated to reflect what you will take home after your tax and national contribution amounts have been deducted. Use our salary calculator to check any salary after tax national insurance and other deductions.

Why not find your dream salary too. The latest budget information from april 2020 is used to show you exactly what you need to know. After tax salary calculator.

50 000 after tax is 37 640. The results are broken down into yearly monthly weekly daily and hourly wages. Income tax estimate your income tax for the current year use this service to estimate how much income tax and national insurance you should pay for the current tax year 6 april 2020 to 5 april 2021.

You can compare different salaries to see the difference too. Most individuals pay income tax through the pay as you earn paye system. 11 income tax and related need to knows.

Updated for tax year 2020 2021. Hourly rates weekly pay and bonuses are also catered for. Uniform tax rebate up to 2 000 yr free per child to help with childcare costs.

Net Salary Calculator Uk 2019 Income Tax Calculator Take Home Pay Calculator Wage Calculator Pay Calculator Income Tax Student Loan Payment

Net Salary Calculator Uk 2019 Income Tax Calculator Take Home Pay Calculator Wage Calculator Pay Calculator Income Tax Student Loan Payment

The Salary Calculator Tells Your Yearly Net Income In Vancouver After Income Tax And National Insurance Contributions Have Been Deducted

The Salary Calculator Tells Your Yearly Net Income In Vancouver After Income Tax And National Insurance Contributions Have Been Deducted

Net Pay For 15 000 Salary After Tax

Net Pay For 15 000 Salary After Tax

Genuine Payslips And Replacement P60 Payslips Prepared By Payroll Experts Order Your Replacement Payslips Onli National Insurance Number Office Names Online

Genuine Payslips And Replacement P60 Payslips Prepared By Payroll Experts Order Your Replacement Payslips Onli National Insurance Number Office Names Online

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Calculator

0 comments:

Post a Comment