On september 24 2019 the department of labor announced a final rule effective january 1 2020 that mandates an increase from 455 per week 23 660 annually to 684 per week 35 568 annually to the salary threshold below which employees must be considered non exempt and paid overtime for any hours over 40 worked in one week. Every state law is different and some exempt employees from the state minimum wage while other states only exempt the employee from overtime hours.

Department Of Labor Set To Change Overtime Exemption Regulations Under The Flsa Payroll Restaurant Management Corporate Law

Department Of Labor Set To Change Overtime Exemption Regulations Under The Flsa Payroll Restaurant Management Corporate Law

Conversely employees who earn below this amount are designated non exempt.

Non exempt salary threshold. For 2020 employees must earn a minimum or 684 per week or 35 568 per year to have exempt status. 1 2020 setting the minimum salary threshold for exemption at 684 per week. These employees are exempt from being paid overtime for hours worked over 40 each week.

A law went into effect jan. Currently the salary threshold for exempt employees rests at 455 a week or 23 660 annually. Beginning january 1 2020 the salary threshold increases making a number of previously exempt employees nonexempt.

This new threshold is effective january 1 2020. The flsa salary threshold is the minimum salary employers must pay employees for them to be exempt from overtime wages. This means that while the employee must be paid at least 90 of the minimum salary throughout the year including nondiscretionary bonuses incentive payments and commissions the employer has one pay period after the year to compensate the employee for any shortfalls that would classify them as non exempt.

The new threshold means that employers who have exempt employees making less than 684 need to either reclassify the employees as non exempt making them eligible for overtime pay when working more than 40 hours in a workweek or need to increase wages to be above the weekly minimum. Some states may have a higher starting pay per week to qualify a person as an exempt salaried employee but it cannot be less than the federal minimum which is 47 476 per year. Also non exempt employees must be paid overtime wages equivalent to at least 1 5 times the california minimum wage of 13 per hour for employers with over 26 employees or 19 50 per hour.

Non exempt employees are entitled to the federal minimum wage and overtime pay in accordance with the fair labor standards act. The salary level test helps determine whether that employee is exempt or non exempt from earning overtime on additional hours worked in a pay period. As an exempt salaried employee he or she must make at least 913 weekly.

The new flsa salary threshold is 35 568 annually or 684 per week. Employees may only be exempt from these laws if they meet specific tests put forth by the flsa. Under the flsa regulations there is a minimum threshold for weekly salary wages.

The salary level test is updated every three years to represent the 40 th percentile of the lowest wage earning sector of the country which is currently the southeast.

How Do You Know If Employees Are Exempt Or Nonexempt New 2020 Guidelines Infographic Workest

How Do You Know If Employees Are Exempt Or Nonexempt New 2020 Guidelines Infographic Workest

Pin On Titan Tax Accounting Services

Pin On Titan Tax Accounting Services

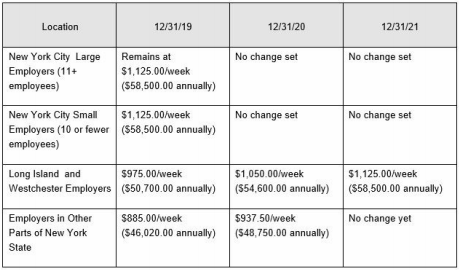

Get Ready For New York Minimum Wage And Exempt Salary Changes Employment And Hr United States

Hr Tip Of The Week Changes To Exempt Classification Could Be Coming Resources Paid Sick Leave Human Resources

Hr Tip Of The Week Changes To Exempt Classification Could Be Coming Resources Paid Sick Leave Human Resources

Flsa Overtime Rule Infographic Rules Employment Law Hr Management

Flsa Overtime Rule Infographic Rules Employment Law Hr Management

Hrm 300 Week 5 Assignment Salary Threshold Legislation Review This Or That Questions Devry University Homework

Hrm 300 Week 5 Assignment Salary Threshold Legislation Review This Or That Questions Devry University Homework

0 comments:

Post a Comment